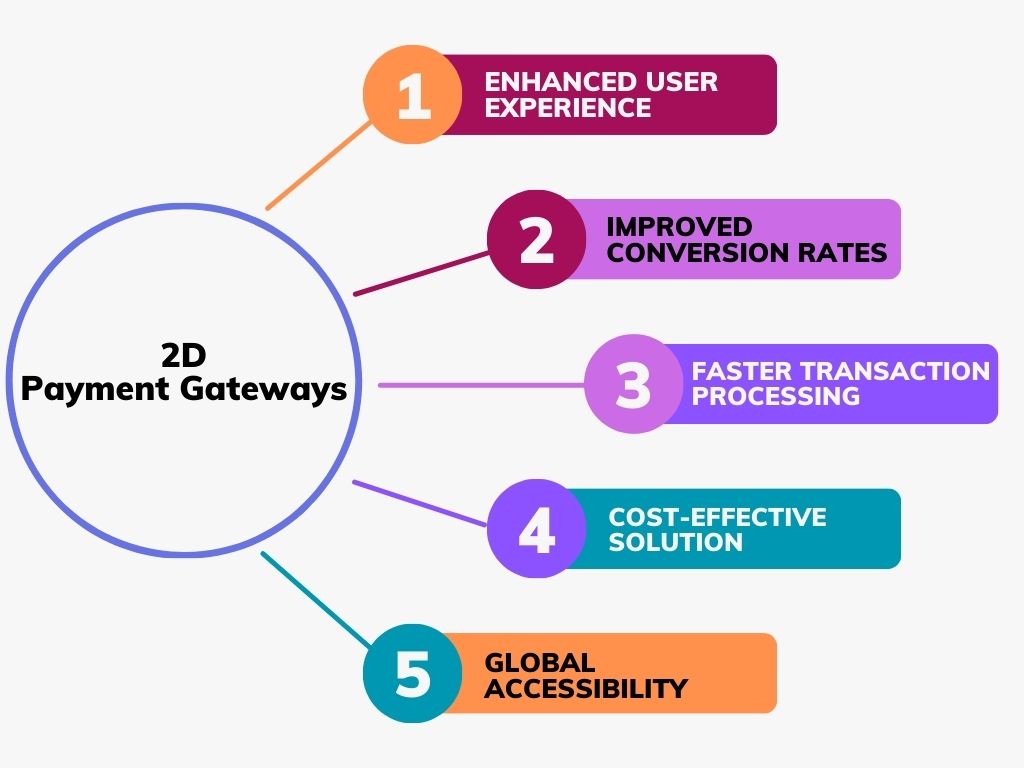

Top Benefits of Carrying Out a 2D Payment Gateway for Online Sales

Top Benefits of Carrying Out a 2D Payment Gateway for Online Sales

Blog Article

The Role of a Settlement Portal in Streamlining Ecommerce Payments and Enhancing User Experience

The assimilation of a repayment entrance is pivotal in the shopping landscape, working as a safe and secure avenue between customers and merchants. By making it possible for real-time deal handling and sustaining a range of payment approaches, these gateways not only alleviate cart desertion but likewise boost total consumer satisfaction. Their emphasis on security and transparency cultivates count on in an increasingly competitive marketplace. As we check out the multifaceted advantages of settlement gateways, it becomes necessary to examine exactly how these systems can even more evolve to satisfy the needs of both consumers and businesses alike.

Recognizing Settlement Gateways

A repayment entrance functions as a vital intermediary in the e-commerce purchase procedure, assisting in the secure transfer of repayment details between sellers and consumers. 2D Payment Gateway. It makes it possible for on-line companies to approve various types of repayment, consisting of credit cards, debit cards, and electronic pocketbooks, therefore widening their customer base. The portal runs by securing sensitive information, such as card information, to guarantee that information is sent firmly online, reducing the risk of scams and data breaches

When a customer initiates an acquisition, the settlement portal records and forwards the purchase information to the ideal monetary organizations for authorization. This process is typically seamless and happens within seconds, supplying consumers with a fluid shopping experience. In addition, repayment entrances play a pivotal function in compliance with industry requirements, such as PCI DSS (Repayment Card Industry Data Safety And Security Criterion), which mandates stringent safety steps for processing card payments.

Recognizing the mechanics of settlement gateways is essential for both sellers and consumers, as it straight influences transaction effectiveness and client trust fund. By making certain efficient and safe and secure purchases, settlement portals contribute significantly to the overall success of e-commerce services in today's electronic landscape.

Secret Features of Payment Gateways

Numerous crucial functions specify the performance of payment entrances in e-commerce, making certain both safety and security and benefit for customers. Among the most crucial functions is durable safety methods, including security and tokenization, which shield delicate consumer information during deals. This is essential in promoting trust between customers and sellers.

Moreover, real-time purchase processing is essential for making certain that settlements are completed quickly, lowering cart abandonment prices. Settlement entrances additionally use fraudulence detection devices, which check deals for dubious activity, further guarding both customers and merchants.

Benefits for Shopping Businesses

Countless advantages emerge from integrating payment portals right into e-commerce services, significantly improving operational effectiveness and customer contentment. First and leading, repayment gateways assist in seamless deals by safely processing payments in real-time. This ability lowers the chance of cart abandonment, as clients can promptly finish their acquisitions without unneeded delays.

Furthermore, payment portals support multiple settlement techniques, suiting a varied variety of client choices. This versatility not just draws in a broader consumer base however additionally cultivates commitment among existing customers, as they feel valued when used their favored repayment choices.

Furthermore, the integration of a settlement gateway commonly leads to enhanced safety and security attributes, such as encryption and fraud detection. These measures secure delicate client details, therefore building count on and trustworthiness for the ecommerce brand.

In addition, automating repayment procedures with gateways reduces hands-on workload for team, enabling them to concentrate on strategic campaigns instead than regular tasks. This functional my review here performance equates right into cost savings and boosted source allocation.

Enhancing Customer Experience

Incorporating an effective settlement gateway is important for enhancing individual experience in e-commerce. A seamless and reliable repayment procedure not only develops consumer depend on however likewise minimizes cart abandonment prices. By offering numerous payment options, such as bank card, electronic pocketbooks, and financial institution transfers, businesses provide to varied customer choices, consequently improving fulfillment.

Furthermore, an user-friendly user interface is important. Repayment portals that supply user-friendly navigating and clear directions allow customers to full deals rapidly and effortlessly. This ease of use is vital, especially for mobile consumers, that require optimized experiences tailored to smaller sized screens.

Safety and security functions play a significant function in user experience. Advanced security and scams detection devices Web Site guarantee clients that their sensitive data is safeguarded, cultivating self-confidence in the purchase process. Furthermore, transparent communication relating to policies and charges enhances integrity and decreases prospective disappointments.

Future Patterns in Payment Processing

As shopping remains to develop, so do the patterns and technologies forming repayment processing (2D Payment Gateway). The future of settlement processing is marked by numerous transformative patterns that promise to boost effectiveness and individual complete satisfaction. One significant fad is the increase of expert system (AI) and artificial intelligence, which are being progressively integrated right into repayment portals to boost security via advanced fraudulence detection and threat evaluation

In addition, the adoption of cryptocurrencies is obtaining grip, with more companies exploring blockchain technology as a sensible alternative to typical payment methods. This shift not just offers lower transaction charges however also interest a growing market that worths decentralization and privacy.

Contactless settlements and mobile wallets are becoming mainstream, driven by the demand for quicker, a lot more practical purchase approaches. This pattern is more sustained by the raising occurrence of NFC-enabled devices, enabling smooth purchases with simply a tap.

Last but not least, the focus on regulative conformity and data protection will form settlement processing methods, as organizations aim to develop trust fund with customers while sticking to developing legal frameworks. These patterns collectively indicate a future where repayment processing is not only quicker and a lot more safe yet additionally a lot more straightened with customer assumptions.

Verdict

In verdict, payment gateways additional reading serve as essential parts in the ecommerce ecosystem, promoting efficient and protected purchase processing. By supplying diverse payment choices and prioritizing customer experience, these entrances significantly lower cart desertion and improve client contentment. The recurring development of repayment technologies and protection procedures will certainly further strengthen their function, guaranteeing that shopping businesses can satisfy the demands of significantly sophisticated customers while cultivating count on and reliability in on the internet purchases.

By enabling real-time transaction processing and supporting a variety of settlement techniques, these entrances not only alleviate cart desertion however likewise boost total consumer contentment.A settlement portal offers as a crucial intermediary in the e-commerce purchase procedure, helping with the safe transfer of repayment info between vendors and clients. Payment gateways play a crucial duty in conformity with market standards, such as PCI DSS (Repayment Card Market Data Security Criterion), which mandates rigorous safety and security steps for refining card payments.

A versatile settlement entrance accommodates credit report and debit cards, digital wallets, and different repayment approaches, providing to diverse consumer preferences - 2D Payment Gateway. Payment entrances help with smooth deals by firmly refining payments in real-time

Report this page